The Rundown

Trading Week: Dec 2–6, 2025 (Mon–Fri)

TLDR: The Dollar got demolished. Weak NFP data crushed the "higher for longer"

thesis, sending EUR and GBP screaming higher while USD/JPY crumbled. Gold treated $4,200 as a

launchpad. Risk-on vibes all week. The Fed is officially on the back foot.

Weekly State Table

| Pair |

Close |

Δ Week |

Regime |

Driver |

| EUR/USD |

1.1638 |

+0.39% |

🟢 Trend |

Weak USD / ECB Hold |

| GBP/USD |

1.3319 |

+0.71% |

🟢 Trend |

UK PMI / USD Sell-off |

| USD/JPY |

155.23 |

-0.53% |

🔴 Reversal |

BOJ Hawkish / Risk-Off JPY |

| AUD/USD |

0.6520 |

+0.25% |

🟡 Range |

China PMI / Risk-On |

| USD/CHF |

0.8810 |

-0.40% |

🔴 Trend |

Safe Haven Flow |

| XAU/USD |

$4,243 |

+1.2% |

🟢 Trend |

Rate Cut Bets / USD Weakness |

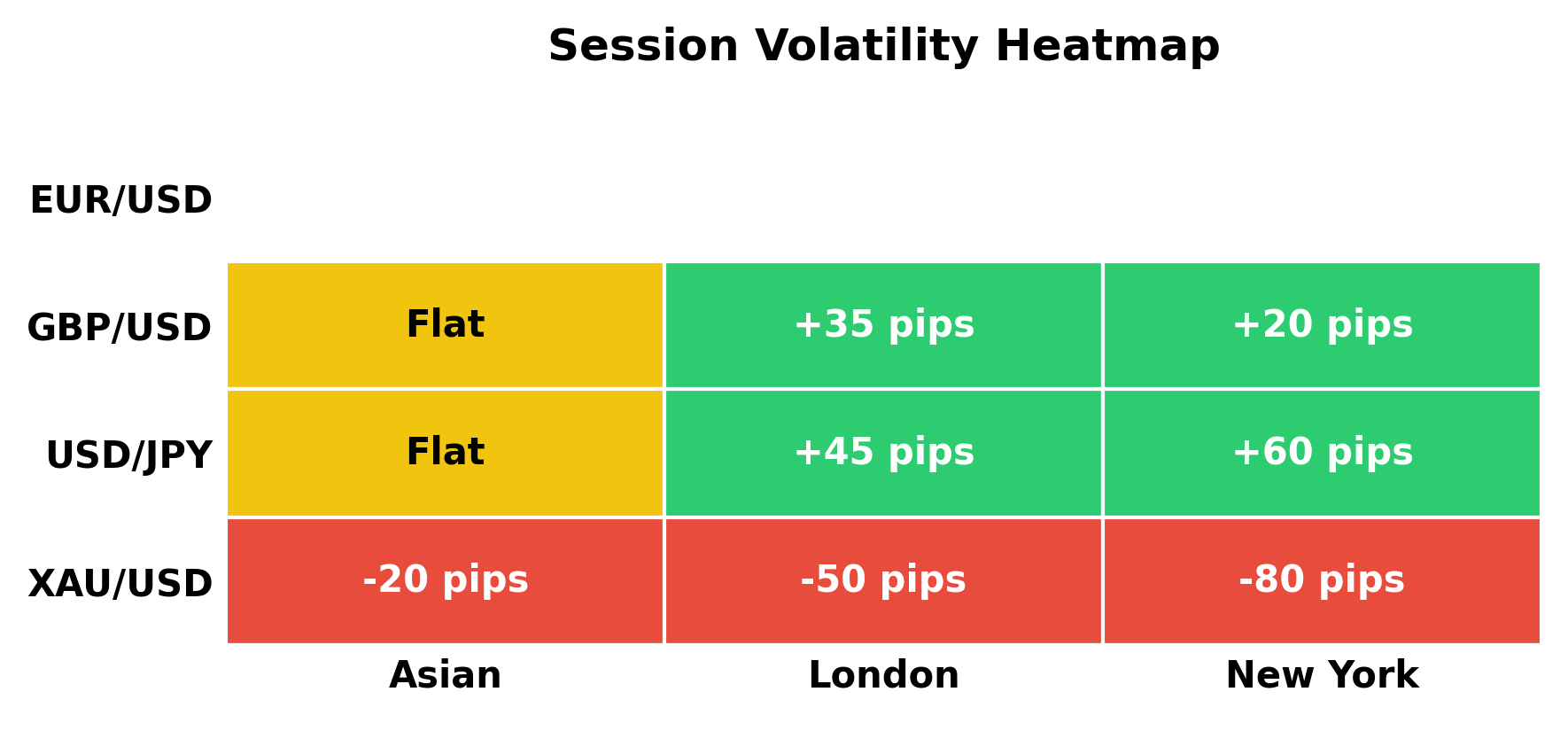

Session Heatmap

Key State Shifts

- NFP Miss: The "strong labor market" equilibrium collapsed. Markets pivoted from

"will they cut?" to "how fast?".

- BOJ Speculation: Ueda's hawkish hints added fuel to the USD/JPY fire. Divergence is

the new narrative.

- Gold Breakout: XAU held $4,200 like a floor, not a ceiling. Monetary debasement

trade is alive.

Momentum View: The trend is your friend, and that friend hates the Dollar.

The Playbook

Trading Week: Dec 9–13, 2025 (Mon–Fri)

TLDR: Central Bank Super Week. FOMC on Wednesday is the main event—expect fireworks.

Bias leans USD bearish, but Powell could flip the script if he isn't as dovish as markets expect.

Stay nimble. Keep stops tight.

State & Bias Table

| Pair |

State |

Bias |

Key Level |

Invalidation |

| EUR/USD |

Bullish / Low Vol |

🟢 Long |

1.1650 |

< 1.1480 |

| GBP/USD |

Bullish / Trend |

🟢 Long |

1.3350 |

< 1.3180 |

| USD/JPY |

Bearish / High Vol |

🔴 Short |

155.00 |

> 157.00 |

| AUD/USD |

Neutral / Choppy |

🟡 Neutral |

0.6550 |

< 0.6450 |

| USD/CHF |

Bearish / Trend |

🔴 Short |

0.8780 |

> 0.8900 |

| XAU/USD |

Bullish / Breakout |

🟢 Long |

$4,250 |

< $4,180 |

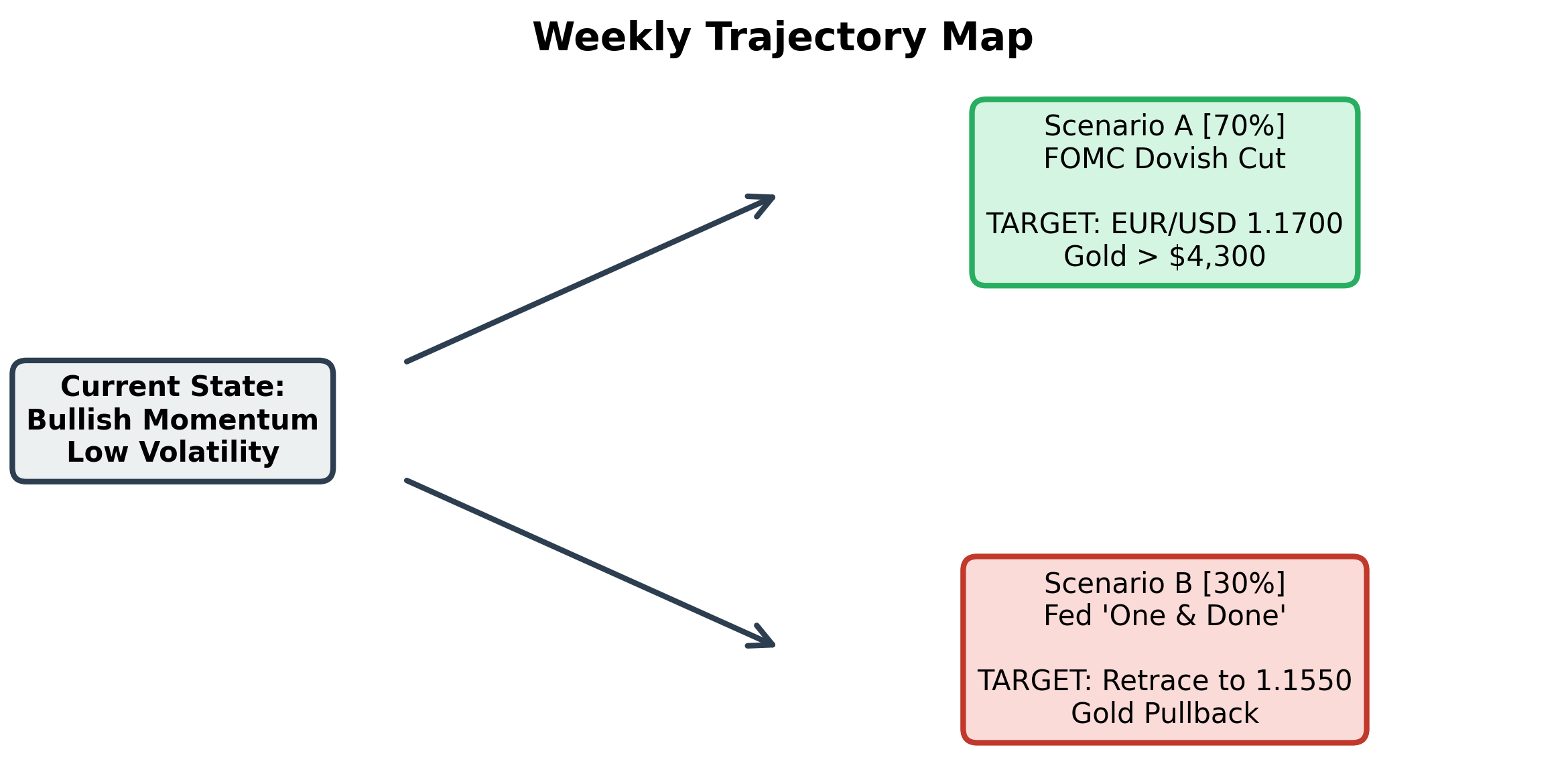

Trajectory Map

Calendar Watch

Tue: RBA Decision, US JOLTS. Wed: US CPI, FOMC Decision (the main event).

Thu: SNB Decision, US PPI. Fri: Germany CPI.

Setups Worth Watching

| Pair |

Bias |

Entry Zone |

Target |

Invalidation |

| EUR/USD |

Long |

1.1580–1.1600 |

1.1720 |

< 1.1540 |

| USD/JPY |

Short |

155.80–156.00 |

153.50 |

> 156.50 |

| XAU/USD |

Long |

> 4250 |

$4,300 |

< $4,220 |

Momentum View: Don't fight the flow, but keep your stops tight—Powell takes no

prisoners.